A reader who saw my last Facebook scam post reached out because her spidey sense was tingling: she’d been looking for a rental property, and although she thought she’d found something awesome, she was worried.

I offered to look over the information she had to see if I could spot any red flags, and unfortunately, there were a few. Scams involving online listings for both short and long term rentals are a big issue, and the FTC and FBI are just two of the places you can find long lists of red flags to watch. outfor. I’m going to dissect this specific situation to show you what set my alarms off here.

How it started

My reader — let’s call her R — told me she found the rental property listed on Facebook. It’s a super cute, clean 3br/2ba in a convenient part of Charlotte, and the rent was — almost unbelievably — just $900. In this market, that’s an absolute steal, so she jumped.

After submitting an application fee of $60 through Zelle, the property manager said he was going to be able to show the home in person. He then changed his mind and sent R a security code to do the walkthrough by herself. Understandably, this made R feel like things were legitimate — how could a scammer have been authorized let her into the house?

But then, the “property manager” started rushing R to send her first month’s payment and security deposit right away, and something about it just didn’t feel right, so she reached out to me.

After reviewing the lease agreement that “Michael Franklin” sent to R, I immediately spotted a few things that worried me.

Weird errors (who misspells their own name?)

This is a small thing, but I noticed it first. On the lease agreement, we see the name Michael, spelled the traditional way:

But when you look at the email address that was contacting R, it looks like:

I don’t know many people who spell their full name differently in their email than they do in a document — I’m sure it happens, but it jumped out at me right away, and “LEGAL LEASE AGREEMENT” as an email header also felt sus to me.

Reviewing the whole lease document, it looked like a very generic “download a free lease agreement template” from the internet — which might be normal! — but the few phrases that were not part of the template looked weird:

“All filled with null”? What does that even mean?

Also, this signature just looks bad to me. Not “illegible handwriting” bad, but “intentionally obfuscated and copy-pasted in a questionable way” bad.

I wasn’t going to base my whole case on that, because plenty of independent landlords probably use those templates (and have messy handwriting), so of course I didn’t stop there — I fact-checked whether the property was even for rent.

ABG: Always be Googling

A quick Google search of the property’s address confirmed my fears and nailed this coffin shut: while the property is actually for rent, Zillow showed that it was listed for $1860, not $900. The property also shows as listed through Progress Residential, a verified national rental real estate chain. (Immediately that “janky DIY lease agreement” red flag got redder.)

My bet: our opportunistic scammer has shoehorned himself between the legitimate property managers and any hopeful renters looking for a deal. “Michael” copied some of the legitimate listing information, stole the photos (not sure if he bothered to crop or conceal the rental company’s watermark, as I’ve done in the header photo for this post!), and set up a fake profile and fake contact info.

Although some scammers can’t actually show their fake properties, “Michael” chose wisely. This property is equipped with a smart lock, which probably saves the rental company piles of money in payroll expenses, since they don’t have to pay someone to go on-site to show the property.

And thanks to this hands-off approach, the situation is ripe for fraud. “Michael” was able to offer R a “showing,” probably by registering himself for a “self-guided tour” and simply passing the security code to R when she arrived for her appointment.

I will note that the property website has a nice little disclaimer to notionally help protect potential fraud victims:

But since I’m pretty sure the fraudster didn’t pass this message along, it’s only really helping people if they manage to find the official listing.

The moral of this part of the story: always be Googling. A little independent research that leads you to a legitimate website can show you if a property is actually for rent, what the true price is, and how to contact the person or company that actually has the authority to rent it to you. A fraudster might even pose as the legitimate rental company, or an agent of one, so you want to ensure you’ve gotten the contact information from a verified source.

As always, watch for bad energy and excessive urgency

R was very eager to move, and I think bad actors can smell that eagerness and answer it with their own. In today’s high-urgency culture, many of us have come to accept rushing as normal, and fraudsters love urgency. They want to get their victims moving too fast to notice red flags.

Legit rental businesses can also move quickly, but they tend to be professional about it, and they’re going to do their due diligence. I asked R if “Michael” had requested a background or credit check; R said he had not, which was another red flag. It is expensive to properly vet tenants, but it’s even more expensive to manage liabilities and evictions, so in a legitimate rental situation, there are typically a few hoops to jump through before they start demanding your money.

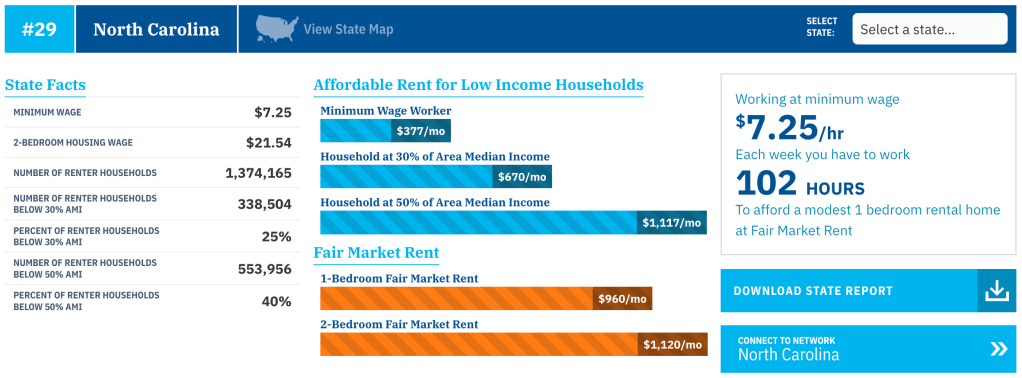

I will note that people who might not pass a background or credit check can still be wonderful tenants, but face many obstacles to finding housing. And even if your credit and background are ok, NC joins most of the country in a serious housing affordability crisis. Working 102 hours at minimum wage will barely pay the fair market rent for a modest 1-bedroom in NC, and it’s probably worse in the Charlotte metro area specifically.

Source: NLIHC OOR State Data

In 2023, a full-time worker needs to earn an hourly wage of $28.58 on average to afford a modest, two-bedroom rental home in the U.S.

– National Low-Income Housing Coalition (NLIHC), Out of Reach (OOR)

In this economy, predatory scammers like this guy have plenty of people to target who are desperate to finally catch a break in their search for a place to live… and their victims can ill afford to lose the $60 “application fee,” let alone $1800 in fake rent and security deposits.

What we did next

Sadly, although R reported the scam “application fee” to her bank, the bank claimed they couldn’t refund the money because she sent it through Zelle. And Zelle typically won’t refund authorized payments, just like most of the peer-to-peer (P2P) payment processors (e.g. CashApp, Google Pay, PayPal, Venmo, and Remitly). The P2Ps, in general, should never be used to send money to someone you’ve never met or don’t personally know — P2P consumer protections are pretty terrible, so you have to be extra-vigilant when using them (more best practices here on protecting yourself, because even an accidental mistake like a typo can lead to major losses with these apps). But we’re not giving up — more on that in a second.

I also sent a note to Progress Residential to let them know that there was an active scam using one of their properties. Although I assumed I was just shouting into the void, I am pleased to report that they called me back within hours. (Granted, it was because they thought I was hoping to rent the property, but still!) When I informed them of the details of the scam, the representative immediately opened a fraud case. Although he said he did not know what specific steps the company would take next, it sounds like they do actually try to do something to mitigate known scam activity, which is more than I expected.

What to do if this is you

Amid the heartbreak of the US housing affordability crisis, I must still deliver the grim news: if it seems too good to be true, it probably is. If you find anything for rent way below market rate, do not let your joy-adrenaline override your common sense. The better the deal, the more on-your-guard you must be:

- immediately Google the address, verify the listing details, and reach out through the contact information that you verify through a separate legitimate channel.

- Be extra cautious with any property that is available for self-touring.

- And finally, listen to your intuition. If something feels weird, dig deeper, ask your most skeptical friend, or reach out to me!

If you sent money to a scam like this, immediately contact the legitimate payment processor (in this case, Zelle) through their app or website and report the fraud, as soon as you realize it. You will also immediately want to contact the bank that holds the account(s) linked to your payment processor and report the fraud. (Immediately means today, not later this week; time is of the essence with fraud deadlines.) As I note above, the P2Ps are terrible about this, and the banks aren’t going to pick up any slack that they aren’t legally required to carry. But that doesn’t mean you shouldn’t try. Reporting the scam and asking (and asking again) for recourse will not guarantee a return of your funds, but these are the first right steps.

As an extra safety measure, and especially if you filled out a rental application and provided any personal information to the fraudster (such as your SSN and date of birth), you should absolutely follow the steps I outline here on what to do if you’re notified that your identity is compromised.

Finally, if you’re feeling particularly vigilante-esque and you come across a scam like this, you can always reach out to the legitimate landlord/property manager to let them know that their property is being used to defraud innocent people.

If you have any questions — or a favorite scam red flag that you’d like to share — drop a comment or shoot me an email at hi@fortunamoney.com. And if you’ve been a victim and you want help navigating your next steps, I’ll be happy to help you create a plan. Cheers!